This post may contain affiliate links. By clicking and making a purchase through the links, I earn a small commission at no extra cost to you. See my disclaimer for more information. This and display ads allow me to keep the site up to date and give back.

Do you need help choosing between Wise vs Revolut? These are two of the biggest money transfer services which offer an easy and inexpensive way to send and receive money in multiple currencies.

Both accounts are ideal for people like digital nomads, who want to transfer funds in different currencies without paying the higher fees charged by traditional bank accounts.

So how do you know which one to choose?

This Revolut vs Wise review will outline the key differences between the companies. I’ll explain their services, fees, and main features in detail, looking at the advantages and disadvantages to help you choose the best account for your needs.

Note: The information below was correct on the day of publication, but financial institutions like Wise and Revolut often change their terms and services. Please check the official company websites for the most up-to-date information.

About Wise

Wise launched in 2011 from its base in the United Kingdom, and the company used to be known as TransferWise. You can use a Wise borderless account to transfer a range of foreign currencies, while the Wise debit card can be used for online and in-store purchases or to withdraw cash from ATMs.

Wise focuses heavily on its money transfer services. Transparent charges, better exchange rates, and low fees have helped to make Wise a popular choice for people who send and receive money in different countries.

Wise accounts are electronic money accounts, so you won’t have access to an overdraft. Your money will still be protected but Wise doesn’t hold a banking license, so your funds may not have the full FCA safeguarding offered by standard banks.

Visit the Wise website to find out more about their services.

About Revolut

Revolut launched in 2015 and also has its headquarters in the United Kingdom. Unlike Wise, Revolut has a limited banking license from the ECB and hopes to receive a UK banking license soon.

The company offers a similar range of services as Wise, so you can easily send and receive money in a range of foreign currencies with better exchange rates than traditional banks. The Revolut card also allows you to use ATMs and shop online and in-store.

Although Revolut was first established to provide money transfer services, their services now cover other areas of financial management, and they also offer junior accounts.

Visit the Revolut website to learn more about their services.

Wise vs. Revolut

Availability

When choosing between Wise and Revolut, you first need to check that the accounts are available in your location.

Wise

Wise accounts are available in most countries, but not all countries have access to Wise debit cards yet. You can see the full list here.

Revolut

Revolut personal accounts are currently open to EEA (European Economic Area) residents plus residents of the United States, Australia, Canada, Singapore, Switzerland, and Japan.

Revolut Business accounts are only available to companies that are registered in and have a physical presence inside the European Economic Area (EEA) or Switzerland.

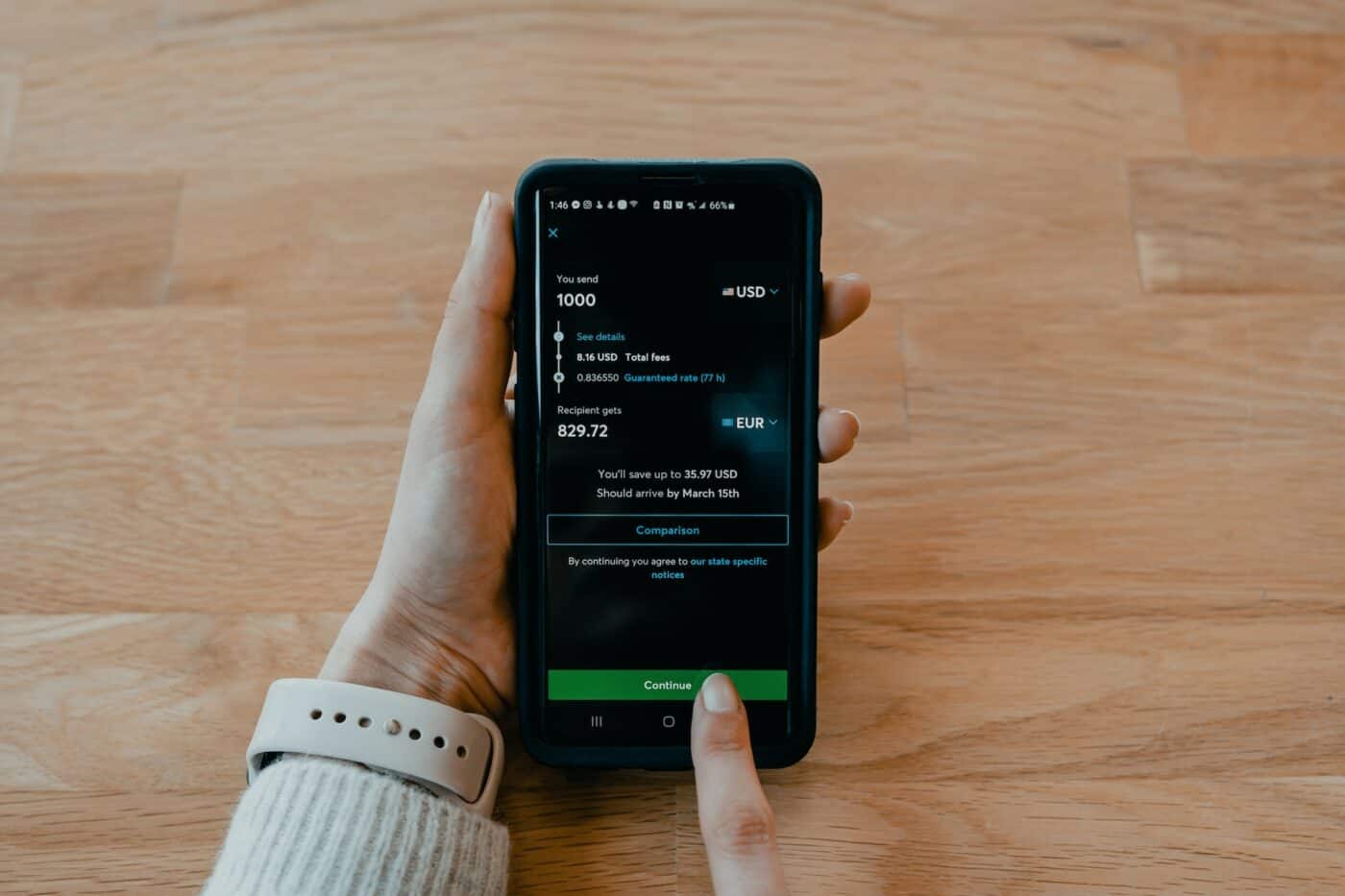

Sending Money

This is one of the main features of both Revolut and Wise, so let’s take a look at how they handle money transfers.

Wise

The time it takes to transfer money and the amount you can transfer will vary depending on the countries and currencies involved.

Transfers generally take no more than two business days, and most are completed much quicker than that. Card payments are typically completed within a few minutes, but bank transfers could take longer.

Free transfers are available if you are moving money from one Wise account to another. Wise charges for transferring funds to a different bank are fixed, and a conversion fee is applied if you are transferring between currencies.

Revolut

As with Wise, the time taken to complete a money transfer will vary. Some transfers could be almost instant, such as transferring GBP to a United Kingdom bank. Other transfers could take up to five business days if the banks don’t support instant transfers.

There’s no fee for sending funds within your foreign exchange limit, and a small fee is charged on cross-currency transfers above this. There are generally no limits on transfer amounts. However, some payment partners may impose their own limitations.

Receiving Money

If you want to use your Wise or Revolut account to receive money, you need to be confident it will run smoothly.

Wise

You receive international transfers into a Wise account the same way as a traditional bank account. Wise will allocate different accounts for each currency you hold, and you’ll give the correct details to the person sending money to you.

You can get local bank details to receive international payments in 10 currencies: USD, CAD, GBP, EUR, SGD, AUD, NZD, HUF, RON, and PLN.

Revolut

It’s just as easy to receive money into a Revolut account. Most international payments into your account will be very quick, but some international money transfers could take a few days to complete.

Revolut accounts can accept international transfers in the following currencies: AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RUB, QAR, RON, SAR, SEK, SGD, THB, TRY, USD, ZAR.

Service Fees

Both companies offer affordable banking and international money transfer services, and their fee structures are pretty similar.

Wise

There is no fee for opening a Wise account or for making purchases in a currency that you hold in your account.

Wise charges the mid-market rate for currency exchange, and the transfer fees will vary depending on the currencies and countries involved. All transfer fees are explained before you make your transfer.

If you don’t have enough of the correct currency for a transaction, Wise will exchange funds from a different currency and charge a small fee for this.

Debit card fees vary depending on where your card was issued. For instance, you can withdraw up to $100 per month with a US-issued Wise Mastercard debit card; after that, there’s a 2% fee.

Revolut

Revolut offers a few different types of accounts, and you get more features as the monthly fee increases. There is a Revolut-free account, but the features are pretty limited on this standard account.

There’s no fee if you use your Revolut card for making purchases in any currencies that you hold in your account.

Transfers are free when made to the same currency, and mid-market exchange rates are available for most currencies. However, there’s an additional cost of 0.5% for exchanges made at the weekend.

If you need to transfer large sums of money, Revolut places fewer restrictions on this than Wise.

Currencies

Low fees and favorable conversion rates make both Revolut and Wise great for sending and receiving payments in multiple currencies.

Wise

You can send and receive funds through Wise in 23 currencies, although some of these have limitations:

USD, AUD, BGN, BRL, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, IDR, INR, JPY, MYR, NOK, NZD, PLN, RON, TRY, SEK, SGD

There are several other countries that you can send money to; check the Wise website for a complete list.

Wise multi-currency accounts can handle more than 50 different currencies with real-time exchange rates.

Revolut

You can use your Revolut account to hold and exchange the following currencies:

AED, AUD, BGN, CAD, CHF, CLP, COP, CZK, DKK, EGP, EUR, GBP, HKD, HUF, ILS, INR, ISK, JPY, KRW, KZT, MAD, MXN, NOK, NZD, PHP, PLN, QAR, RON, RSD, SAR, SEK, SGD, THB, TRY, USD, ZAR.

If you specify a currency for a transaction but don’t have sufficient funds in that currency, your payment will be declined. To go ahead, you’ll need to top-up your account, exchange funds from another currency, or link your card to a different account with sufficient funds.

If you specify all currencies, Revolut will take funds from the local currency first, then your base currency, and then the next foreign currency with sufficient balance.

Debit Cards

Whether you choose Wise or Revolut, you can use your debit card to withdraw funds at ATMs, shop online, and at physical stores.

Wise

You can use any currency in your account balance to pay for items with your Wise multi-currency card. The real exchange rate is used to convert funds, which keeps costs down.

Once you have a physical card, you can also hold up to three virtual debit cards to add an extra layer of security to online shopping.

Revolut

Revolut cards may be either Visa or Mastercard, depending on where your multi-currency card is issued. They support ATM withdrawals and card payments in over 140 countries, and the cards allow contactless payments. You can use your Revolut card anywhere that a Visa or Mastercard debit or credit card is accepted.

The fee for ordering a Revolut debit card depends on where your account is registered. Your Revolut account can have up to three physical cards and up to five virtual cards.

Most in-store and online purchases made using the Revolut card will not attract any fees, and converting your money between foreign currencies is free.

Business Accounts

Wise and Revolut provide low-cost digital business banking services that offer business customers an alternative to standard accounts.

Wise

Signing up for a Wise business account from the USA is free. However, you’ll be charged $5 for a Wise business debit card, and there’s a small fee for sending international funds, which varies by currency. You can use your Wise business account to transfer funds, handle payroll, and pay invoices in over 50 currencies.

Wise business customers will pay a $31 charge to set up account details for each currency. It’s free to receive money in AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, and USD (non-wired), while there’s a small charge for receiving wired USD funds.

Revolut

Only businesses with a physical presence in the European Economic Area or Switzerland can open a Revolut business account. The account is currently limited to certain business types, and there’s also a short list of industries ineligible for a Revolut business account.

Various Revolut business accounts are available, each with its own set of fees. Revolut business customers can have two Revolut accounts (EUR and GBP) and hold funds in up to 28 currencies.

Additional Features

In addition to the services listed above, each company offers additional features you might find helpful.

Wise

Wise accounts have a handy feature called Jars which allows you to hold funds separately from your main Wise account. This is a convenient way to save for a big purchase or to put money aside to cover bills. The funds in a Jar can’t be used to pay direct debits or for debit card purchases.

Wise integrates with accounting software like Quickbooks or Xero and is compatible with Google Pay and Apple Pay.

Revolut

Revolut also offers a ‘savings pot’ feature, which they call Vaults. You can make one-off deposits, set up a recurring payment into your Vault, or use their round-up feature to deposit spare change from purchases. Personal customers can also set up a group Vault with family or friends to save towards a joint purchase like a holiday.

There is also a handy group bills function that lets you split expenses among a group of people.

Revolut Premium or Metal members enjoy additional perks like airport lounge passes and a concierge service. Revolut Business members can connect their accounts to software services like Slack and Quickbooks. All members can use Apple Pay and Google Pay, and they offer other financial products like junior accounts and pet insurance.

These are just a few of the growing range of services that Revolut offers.

Customer Support

If anything goes wrong with your finances, you need to feel confident you’ll receive prompt support. So good customer service is a vital factor.

Wise

The Wise website has a comprehensive help section that will answer most of your questions. You can contact their customer support team by live chat, email, or phone if you need personal assistance.

I recently had to make a large transfer from Canada to Mexico and had to call Wise customer support – I was impressed at how quickly they answered and the support they provided throughout the experience.

Revolut

Revolut also has a detailed help section on its website, and you can contact their customer service team through the live chat feature on the Revolut app. You can also join the Revolut community on their website.

Trustpilot ratings

TrustPilot ratings can be a helpful way to see what users think of the companies.

Wise

Wise has nearly 190,000 TrustPilot ratings on Trustpilot, with an average score of 4.4 out of 5. Customers generally expect good service from a financial institution, so this is an excellent score.

Wise account holders like the speed of money transfers, low charges, transparent fees, and excellent customer service. They give Wise particular praise for making multi-currency exchanges simple and not having any hidden fees.

Revolut

Revolut has just under 125000 Trustpilot ratings with an average score of 4.3 which is still excellent for a financial company.

Revolut users praise the company for their low fees, excellent features, and fast mobile app. The ease of use makes it simple for Revolut customers to travel and do business abroad.

Safety

Wise and Revolut are both reputable financial services companies that you can use with confidence. They use two-factor authentication to secure customer log-in, and the schemes operated by Visa and Mastercard protect card payments against fraud, loss, and theft.

Both companies hold their clients’ funds with their global banking partners, giving your money some protection. However, they are not currently licensed banks and digital banks can’t protect your funds as traditional banks do.

So it’s not advisable to use these accounts as your primary account or to leave large sums of money in them.

Revolut vs Wise: Which is right for you?

Choosing between Wise vs Revolut can be tricky because different people need different features in a money transfer service.

There’s no clear winner in this contest, so here’s a quick round-up of the pros and cons of each service:

Advantages and disadvantages of Wise

- Wise has lower transaction fees than Revolut, and real-time online calculations make it easy to see how much your transaction will cost.

- Sending and receiving funds is easy, and the intuitive app helps you keep track of your money.

- Wise is an excellent choice for individuals and sole traders who need to transfer smaller amounts of money.

- The Jars function is useful for saving towards big goals.

- Wise has a TrustPilot rating of 4.4 out of 5 stars, slightly higher than Revolut.

- But Wise only offers a few other features, so it isn’t suitable if you want budgeting tools or features like bill splitting.

Advantages and disadvantages of Revolut

- Revolut offers lots of extra features like Vaults and bill splitting.

- You can attach three debit cards to your Revolut account, compared to one Wise card. They also offer more virtual cards than Wise.

- Transaction fees are low, and the fee structure is clearly explained.

- The web and mobile applications are fast and easy to use.

- Revolut’s Trustpilot score is an excellent 4.3 out of 5 stars.

- But there’s no phone support available from Revolut.

- There’s also a monthly limit on international money transfers, making Revolut less flexible than Wise if you need to send large sums of money.

—

Your personal situation will decide which is the best choice from Wise vs Revolut. In short, Wise is the better option if you only need a reliable money transfer service, and it also has lower fees.

But if you are based in one of the EEA European countries, want additional features, or need access to more countries and currencies, Revolut is the better choice.

The services offered vary depending on your location, so it’s essential to check the precise details before you sign up for an account. That will allow you to make an informed choice and pick the best money transfer service to suit your requirements.

Leave a comment