This post may contain affiliate links. By clicking and making a purchase through the links, I earn a small commission at no extra cost to you. See my disclaimer for more information. This and display ads allow me to keep the site up to date and give back.

One of the most common questions I get asked as a full-time nomad is what is the best travel insurance for digital nomads is? And my answer is simple – SafetyWing.

In this SafetyWing review, I will walk you through why I believe they are the best insurance for digital nomads, what they cover (and don’t), and hopefully convince you why you need health insurance in the first place!

Best travel insurance for digital nomads: SafetyWing

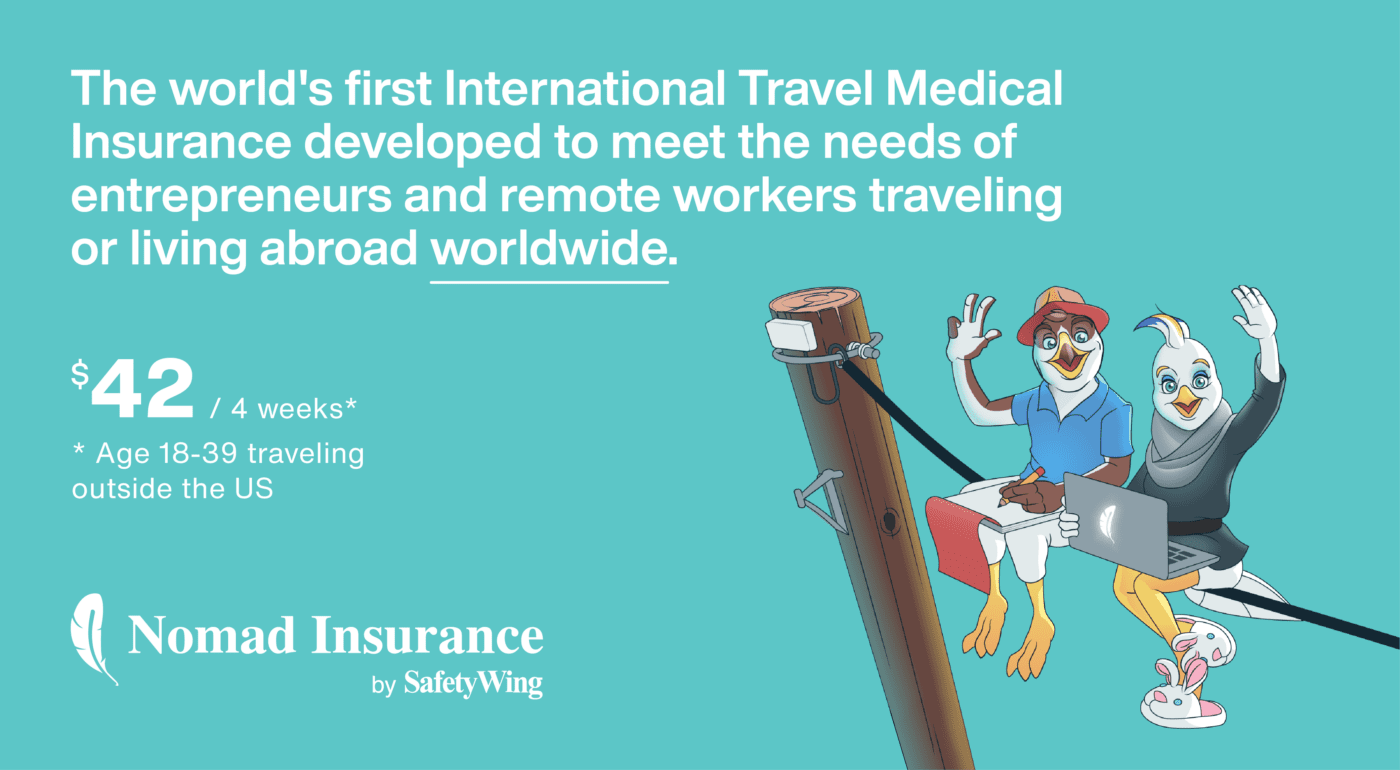

SafetyWing is insurance designed to meet the need medical and travel needs of digital nomads outside their home country.

It’s a subscription-based service, so you pay every four weeks and can cancel anytime.

If you sign-up for automatic monthly renewal, the coverage will automatically extend every 4-weeks until you cancel or to a maximum of 364 days.

If you are away longer than 364 days, you must re-purchase new coverage with a new policy, and the deductible and benefits will reset.

One of the best parts about SafetyWing insurance is that you can buy it even if your journey has already started, which is not common in the insurance industry.

Another perk is that after being abroad for 90 days, you keep your medical coverage for 30 days in your home country if something happens while there. (15 days if your home country is the U.S.)

How much does SafetyWing Cost?

The cost of SafetyWing depends on your age and if you want to include coverage in the U.S.

If you are between 10-39, the price is 42 USD every four weeks (76.72 if you want to include the U.S., which you can remove and add on at any time, but it does reset your deductible). So my insurance for the year is $504 (42×12), which is a great deal.

The price increases the older you are – you can use their online calculator to see exactly how much it will cost.

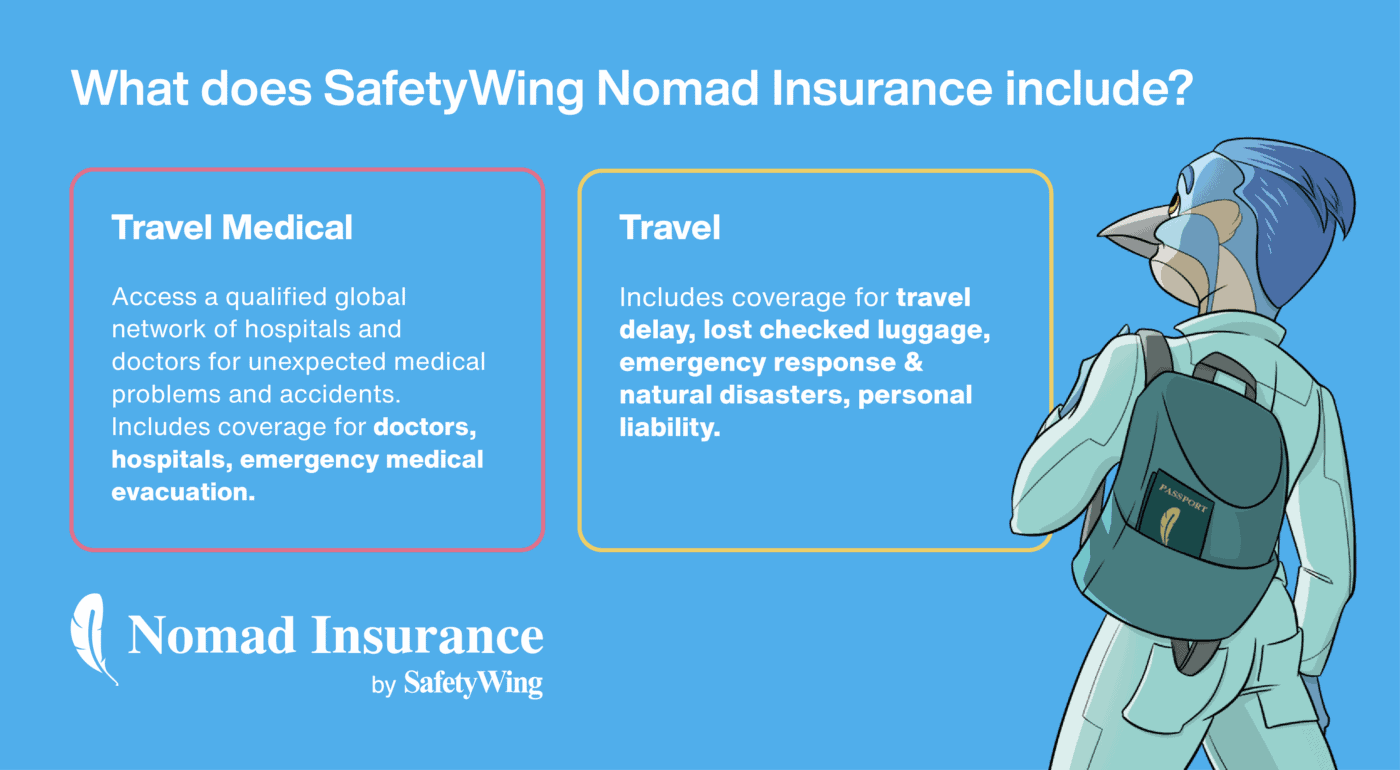

What does SafetyWing nomad insurance cover?

Medical insurance for nomads

SafetyWing Will cover you if are suddenly in an accident or fall sick while outside your home country and need medical assistance. For a complete list of what is covered, check here.

They have a max limit of $250,000 and a deducible of $250 (so for anything less than that, it wouldn’t be worth claiming unless you’ve already paid the deductible). They also cover $1,000 in emergency dental.

SafetyWing does NOT cover Pre-existing disease or injury or Cancer treatment, which is pretty standard for travel insurance providers.

Does SafetyWing cover adventure sports?

I love extreme outdoor adventures, whether paragliding over the Himalayas in Nepal or diving into the deepest waters of Belize.

And fortunately, many sports are included, like bungee jumping, scuba diving, canyoning, and zip lining, but some are not – like white water rafting. So make sure to check the description of coverage and buy additional insurance if you are going to be doing that activity.

If you’re looking for additional insurance for adventure sports, check World Nomads as they cover most of them. Since World Nomads allows you to buy insurance for shorter periods, you can always buy it for the days you need coverage.

Does SafetyWing cover Covid-19?

Yes! SafetyWing was one of the first insurance providers to start covering Covid-19 in spring 2020, which is part of the reason I felt comfortable traveling again and one of the reasons they are the best nomad insurance.

It also covers quarantine outside your home country of $50/day for up to 10 days if you have had the insurance for 28 days, and a physician or governmental authority mandates your quarantine. It is limited to once within a 364-day period. Covid-19 Tests are only covered if mandated by a physician.

Travel insurance for nomads

On the travel side, they have coverage for travel delays, lost checked luggage, emergency response, natural disasters, and personal liability.

This means if you have to cancel your trip, you can be reimbursed for costs you’ve already spent. Or if the airlines lose your luggage, which we all know they love to do…

What countries does it cover?

You are covered for travel anywhere in the world outside of your home country, except Cuba, Iran, Syria, and North Korea.

It is s available to anyone from any home country in the world unless your home country is Iran, Syria, North Korea, or Cuba.

Does SafetyWing cover product loss?

Unfortunately, at this time, SafetyWing insurance does not cover any theft or loss of products. But it is a product they are working on, which I will definitely buy once they do!

Since I travel with a lot of expensive photography equipment and laptop and once had it all stolen in Iceland, I buy separate insurance through a company based in Toronto.

I know a lot of nomad friends in the U.S. who get it directly through their home insurance policy, but if you do this, just make sure that there are no limits on how long you can be out of the country.

You can also get insurance for personal belongings with World Nomads, to a certain amount.

Claiming with SafetyWing

I claimed with SafetyWing when I had dengue fever in Barbados, and overall, it was a relatively painless experience (the claim process, Dengue nearly killed me).

The main thing I disliked about the claim process was that they couldn’t confirm it with me when I called to see if my bills would be covered in advance. But in the end, everything was.

I had a home doctor come to me who couldn’t bill directly, so I paid my bills in advance and then submitted them afterward. I could do this all online from my computer in bed and had the money back in my account within two weeks.

If you go to a hospital within their network, they may be able to bill directly.

You should know that the company that handles your claims is called Tokio Marine, so when you start the claim process, you won’t be dealing with “SafetyWing” anymore. Still, the company was easy to work with.

Why digital nomads need health insurance

The amount of travelers I meet who don’t believe they need travel insurance astounds me. For some reason, people seem to think they have an invisibility cloak when they travel, which is not true.

I’ve seen travelers destroyed by motorcycle accidents in Vietnam, friends fall out of windows in Peru (yes, really), and drunken brits get hit by cars. I’ve personally suffered Dengue fever in Barbados and countless food poisoning incidents, with the worst in Pakistan.

And yes, it’s true, many countries have affordable medical care. But not all countries. And if you need to be airlifted to another country – that will not be cheap. I just don’t see the point in risking bankruptcy when you can get insurance for such a low price.

As someone who has experienced many things go wrong abroad over the year, I can tell you it happens more than we’d like to believe.

And while you can’t control everything when you’re traveling, there is one thing you can do to protect yourself when things do go wrong. And that’s buying travel insurance.

But don’t just take my word for it. I wanted to show you the importance and benefits of buying travel insurance, so I’ve asked some fellow travelers and digital nomads to share their opinion.

Medical Issues

When traveling to new countries, it’s prevalent to become sick from food poisoning/intolerance to foreign foods.

Most of the time, this can pass on its own, but sometimes you get a new bacteria that your body can’t fight. It happened to me while visiting Pakistan, and I ended up in the hospital.

This was also the case of Steve from The Trip Goes On, who wished he had bought travel insurance after getting sick in Thailand and ending up in the hospital.

I didn’t always worry about travel insurance when going away, but after I got sick in Thailand in 2017 and spent a fortune on hospital tests, as well as missed flights, I vowed that it would be a mistake I wouldn’t repeat again!

I was in Thailand to meet a friend from back home and towards the end of our stay on Ko Samui I started to come down with a fever. As we made our way back to Bangkok on the overnight train I felt worse and worse.

I had spent a couple of days trekking and camping in the jungle on the Thai/Myanmar border a week before and worried that I had picked up some sort of tropical disease.

I was due to fly to Vietnam when we arrived in Bangkok but was so ill that I booked into a hostel and then headed to the nearest hospital. It was then that the realization dawned on me that I had to pay not only for any treatment but also for the diagnoses and tests. Coming from England where we have the NHS, this was a bit of a shock.

After tests for malaria and dengue fever (both negative) and subsequent antibiotics, the hospital bill came to almost $400. I really kicked myself for scrimping on the insurance!

And this was in a country like Thailand, where medical treatment is relatively cheap.

In other countries, things can get expensive quickly. Just ask Betsy of PassingThru, who had a life-threatening heart problem abroad.

In February 2018, I was sitting at the swim-up bar at a resort near Colombia’s Tayrona National Park, by the Venezuela border. When it came time to exit the pool, suddenly I couldn’t breathe.

A cardiologist at a public clinic in nearby Santa Marta thought I had a pulmonary embolism, but even more alarmingly, discovered my aorta had dissected (split apart) sometime earlier and there were two threatening aneurysms.

I was a ticking time bomb in a remote location with substandard care. In the ICU all around me, people were dying of things like tuberculosis and worse.

Fortunately, we had purchased comprehensive travelers medical insurance through Allianz Insurance. My husband was able to communicate our situation with them via their iPhone app, and they arranged for direct payments to both of the clinics at which I received treatment.

After a harrowing three-hour escape by ambulance from the first clinic, I underwent lung surgery at a second. This was an outstanding tertiary care facility in Barranquilla.

The professionals there stabilized me sufficiently so that I could return to the US with a medical escort and be further treated for my aorta condition. All told, the covered expenses totaled more than $20,000 USD.

It’s safe to say without travel insurance, I wouldn’t be alive today.

Generally, in Western countries, medical bills can add up quickly. Just ask Eloise of My Favourite Escapes, who had to fly home to Australia to avoid expensive medical bills in France.

I had been an expat for a few years and knew I didn’t have any health cover in my own country anymore, but still didn’t think travel insurance was necessary. We’d fly to Paris and visit a few other European cities, staying with friends and family. We are young and healthy and had no adventurous activities planned.

But as I was quietly sitting at the dinner table while on holiday in France, my right index finger got locked into a bent position. I thought nothing too bad could have happened.

Three health practitioners later, my faith was gone. There was nothing they could do to help me without further investigations like x-rays, ultrasounds, maybe scans… and the opinion of a surgeon.

My best option financially was to wait and go back to my other home in Australia to get it fixed. I felt silly not to have travel insurance.

Long-haul flights always feel like they’ll never end. Well, this one was even worse. I’m not sure what was the hardest: the pain or the anxiety from not knowing what was happening to my right hand. Had I been travelling alone, I wouldn’t have been able to manage the trip on my own.

It took x-rays, ultrasounds, a surgery, 14 stitches, and a few follow-up appointments to get better. Without insurance, it would cost more than $2,500k. I felt lucky I had the option to wait…

Another good use of travel insurance is to protect yourself in case of a vehicle accident abroad. This is especially common throughout Asia, where travelers and locals use motorbikes to get around.

While fun, they can quickly turn into a nightmare. Just ask Mitch from Project Untethered, who had a motorcycle accident in Thailand.

During my very first week backpacking, I rented a big Enduro motorcycle to explore Koh Tao, Thailand. I heard how common crashes were, but I figured it was mostly people who had never ridden a motorcycle before. I had a crotch rocket back in the US (which, ironically, I also crashed), so I thought I’d be ok. Plus, I wanted an adventure.

I decided to take the bike out to explore the more remote areas of the island, which required riding on some gnarly dirt paths (the ones Google specifically warned not to go on).

The path turned ugly real quick, and I found myself way outside my comfort zone. I didn’t know whether it would be more dangerous to turn around, or to keep going. I kept going.

That’s when I took a spill.

Luckily, the path was so bad that I was riding very slow and only suffered a few scrapes. I had to go to a local doctor for some stitches in my arm, and then return every day for a week to have my wound cleaned.

Reimbursement for my treatment was fairly straightforward. I just took pictures of my receipts, filled out an online claim form on the World Nomads website, and waited for it to be processed.

It only saved me about $100 (the medical treatment was super cheap there), but it could’ve easily been much worse!

SafetyWing does cover moped/scooter accidents as long as the accident does not fall under any exclusions, such as racing and intoxication.

And if you’re an adventurous traveler like myself, the risk of accidents becomes even higher while traveling.

This was the case for Chris of More Life In Your Days, whose travel insurance saved the day after a snowboarding accident in France.

Having travel insurance saved the day when I crashed whilst snowboarding in France. After a few moments composing myself, it became obvious that this was more than a bit of a bump.

We flagged down some help and got the ski patrol to come to my rescue. They wrapped me up in blankets as the cold and shock began to set in and then and took me down to the village on a sled.

At the bottom must be one of the world’s shortest ambulance journeys as they drove me about 100 meters to the medical center.

Inside the doctors did their thing and set my wrist in a cast (so much pain!). It was a private hospital so everything needed to be paid for and the costs of treatment and rescue add up pretty quickly. Even that 1-minute ambulance journey was a couple of hundred Euros.

Fortunately, we had annual travel insurance with Flexi Cover that covered us for winter sports. We contacted the insurers and they were able to sort everything out very quickly. They called through to the medical center and confirmed that they would cover the costs upfront.

Overall we saved about 600 euros by having bought travel insurance in advance and it also meant I could get the treatment needed without having to worry about how to cover the costs.

Unexpected Events

Aside from medical conditions, travel insurance can also cover expenses related to events that disrupt your travel plans.

No one could have predicted the volcanic eruption in Iceland that caused massive travel disruptions across Europe, but Hannah from Solar Powered Blonde was grateful to have travel insurance when it happened.

I think everyone remembers when the volcano in Iceland erupted and there was a week of travel disruptions. Luckily but also unluckily for me I was in Egypt for two weeks.

The day before we were supposed to fly home the volcano erupted. I was only young at the time, and definitely could not afford to spend another week at the Hilton hotel. I had saved up for ages to go on a trip to Egypt with my best friend and her family.

If it hadn’t been for good insurance that covered us for natural disasters, then we would have spent at least 100 Dollars each a night on accommodation, not even including the price of food and drinks.

The best thing about the whole experience was that as there were 9 of us, we got upgraded to a villa on the beach, to allow the rooms to be free for other guests stranded in nearby hotels. I was very lucky to have good insurance, as some people sat at the airport for days waiting for the next flight!

Travel insurance can also cover lost luggage, a common problem when traveling via air. Just ask Nabiha of Verses by a Voyager whose bags did not make it with her to Cappadocia, which thoroughly disrupted her travels.

During my recent trip to trip to Turkey, my bags were left at the Istanbul airport due to the negligence of the airline, and didn’t reach Cappadocia.

Even after many calls and emails to the airline, they didn’t give me any satisfactory response. I was in Cappadocia without any clothes or other necessary items.

I had to travel from Cappadocia to the Kayseri airport which (more than an hour drive) to inquire about my bags, multiple times. This completely disturbed my budget as well as the trip itinerary.

In this scenario, my travel insurance was very useful. I had bought travel insurance from MetLife insurance before my trip which covered lost and damaged baggage.

I emailed them with the baggage missing slip and within 5 days I was paid the amount of insurance specified for lost baggage. This was a great help, as it made up for the additional expense I had to incur to buy new stuff as well as traveling between Cappadocia and Kayseri airport.

Nomad travel insurance for delays

Travel Insurance also typically covers expenses from flight delays and cancellations, giving you peace of mind that if your flight gets delayed and the airline doesn’t give a crap (as is often the case), you’ll be reimbursed for unexpected lodging and food expenses.

But did you know travel insurance may also cover your transportation delays outside the airport? This was the case for Danielle of Live In 10 Countries, whose insurance reimbursed her for a train delay that caused a missed connection.

Back in the day I saw insurance as pretty optional for a European country, because I thought they basically don’t pay out on anything that’s common and likely to go wrong.

I was wrong, and a travel policy really rescued me on a recent trip. I’d had a quick jaunt in Hastings (England) and boarded a coach to London for a long weekend in Brussels, with a hotel and Eurostar trip booked.

It was a crack of dawn departure, so I just slept my way along the motorway blissfully. I didn’t even notice that the journey was taking way too long, or that we spent an extra two hours on the road. Sweet dreams indeed.

It was only when we reached our destination, so way too late to change or cancel anything that I realized we’d completely missed our international train, thanks to a huge traffic jam.

I thought a missed connection wouldn’t be covered but thanked my lucky stars when World Nomads refunded the cost of the alternative train I had to book, less my excess. It made a huge difference.

SafetyWing Vs. World Nomad’s

In my backpacking days, I used World Nomads travel insurance and still think they are a great insurance provider. However, as a full-time digital nomad now, SafetyWing makes way more sense for me because of their price point and the benefits offered.

World Nomads isn’t designed for the needs of digital nomads. Instead, their policies are for adventurous travelers with coverage for overseas medical, evacuation, baggage, and a range of adventure sports and activities.

If you’re going on a shorter backpacking trip and plan to do a lot of adventure sports, they may be a better option for you. They also have a much higher emergency medical expense limit ($5,000,000).

But on the other side, the policy is going to cost more. You can get a quote below, but looking quickly on the online calculator, one month in Thailand would cost me half a year of a policy with SafetyWing.

The main benefit of World Nomads over SafetyWing is that they have some coverage for personal belongings (although it’s not much), they cover a more comprehensive range of adventure activities, worldwide coverage, and a lower deductible ($100). But you’ll pay CONSIDERABLY more for a policy, like 3-5x/month more.

Why SafetyWing is the Best digital nomad insurance

The best health insurance for digital nomads is SafetyWing. It’s a fantastic price, it’s straightforward to set up, and you get coverage in your home country. Plus, the deductible is per policy period meaning if you pay it once and claim again that year, the entire thing will be covered.

I’ve met the staff several times at blogging conferences, and they are truly passionate about what they do. In addition to nomad insurance, they also offer insurance for remote teams and have a number of other exciting products in development.

If I’ve convinced you why SafetyWing should be your nomad insurance provider, you can get a quote right here!

Aspiring digital nomad? Check out these posts!

- Best backpacks for digital nomads

- 10 cheapest places for digital nomads to live

- European countries offering digital nomad visas

—

Leave a comment